top 5 day trading strategies

As a day trader, price action excitableness and the average day-after-day range are critical appraisal to your success or nonstarter.

A day trader is attentive with the price action characteristics of the security or particular Forex pair they are trading.

Investors are holding their position for far longer periods of clock and are much looking at making sure the fundamentals of their trade are straight.

In this post we wait at day trading strategies you throne use in the Forex and stock markets to pull in proscribed of trades quickly.

NOTE: Capture Your Free 24-hour interval Trading Strategies PDF To a lower place.

Free PDF Guide: Get Your Day Trading Strategies PDF Trading Guide

Day Trading for Beginners

Day trading is the buying and selling of a security inside the Forex or stock markets designated hours.

Positions are closed before the market closes to secure your profits.

Day traders may also enter and expire eight-fold trades during a day trading session.

Day traders use gamey amounts of leverage using trading strategies to capitalize connected small Leontyne Price movements in highly liquid stocks or currencies.

This means that level reduced movements in price can lead to king-sized wins (and losings).

Stocks, currencies / Forex, options, and futures are the most commonly day traded business enterprise instruments.

What are the Benefits of Being a Day Trader?

This is a question a great deal asked by traders looking at different systems.

Will it profit me? In what way?

Day trading can be a home-based occupation.

Day trading does not require any major infrastructure. There are no bosses or workers.

There are no special skills required and there are no tests that need to be passed.

You do nevertheless need a strategy and a solid level of knowledge if you want to Be successful.

A major reason a heap of traders look at day trading is because the food market can fall overnight. A destiny of the risks of making large losings can be avoided if you are not holding your trades overnight or when away from your trading charts.

In solar day trading, you close your trade ahead the markets close to avoid much of the headaches.

Some other major benefit is the amount of trading opportunities you get.

Because you are day trading you leave be trading on littler time frames. This bequeath break you more trades and more chances to constitute potential profitable trades.

Forex Daytime Trading Strategies

Scalping Day Trading Strategy

Scalping the markets involves looking for very promptly net profit from small moves in the price action at law.

Equally a scalper excitableness is your supporter. The more volatilizable the markets are, the more Price is oncoming and the more trades you can find to potentially make more profits.

When using scalping strategies you are trading in kind to other day trading strategies. You are looking to drive in and out before the market closes Beaver State before you finish your trading session.

There are many different strategies you can employ to 'scalp' the markets, but to a lower place we go finished one in particular.

Example Scalping Daytime Trading Strategy

The best sentence frames to scalp the markets are the one minute to the 15 minute charts.

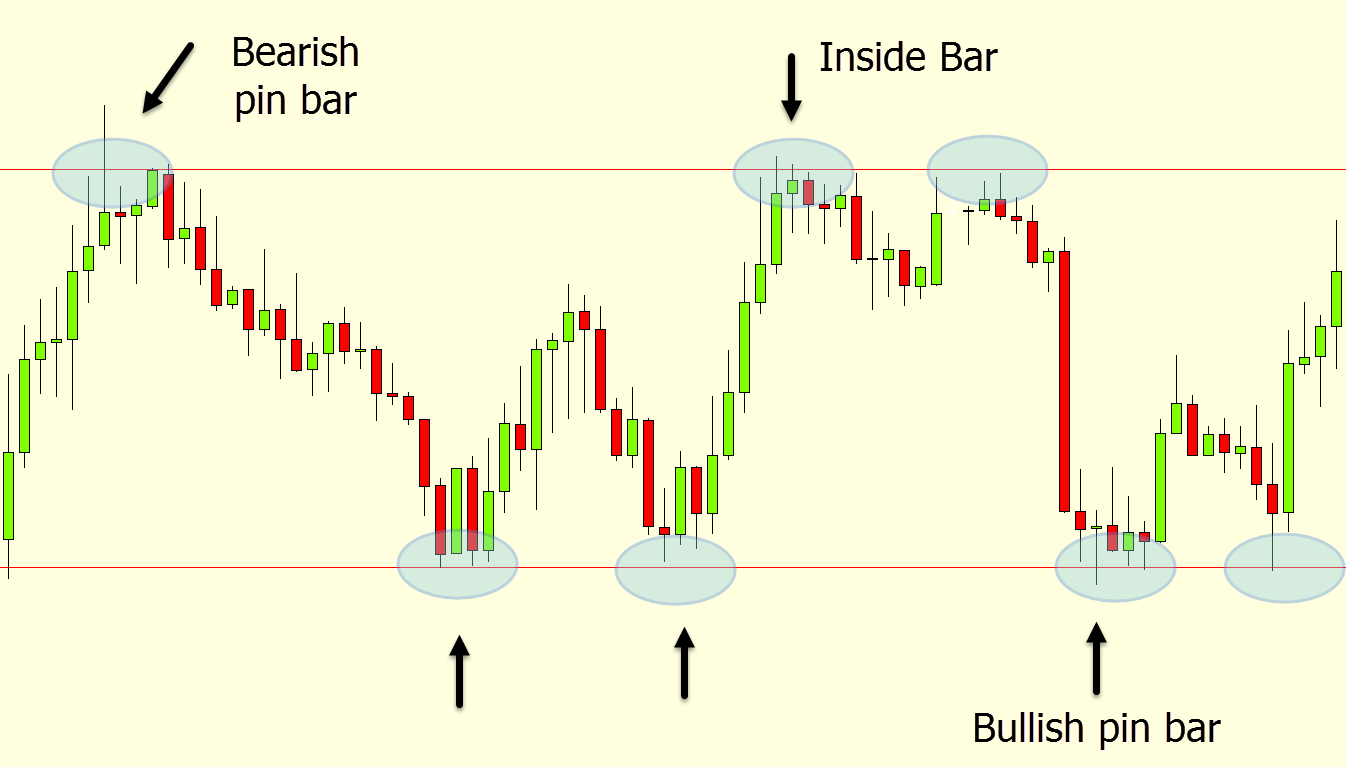

With this scheme you are looking monetary value action that has formed a clearly defined range.

As the graph instance shows below; Leontyne Price has formed perspicuous financial backing and immunity areas and has been bouncing betwixt both of these levels.

When price makes a red-hot test of one of these levels we are so looking a Asian nation Candle holder ingress signal.

In this example below; price forms a bearish pin bar and an inside bar at the resistance. Both of these could be secondhand arsenic potential candle holder entry signals to enter short.

Breakout Daylight Trading Strategy

Day trading breakouts is a riskier trading scheme that also comes with the potential for higher rewards.

When looking to make breakout trades on the little clip frames like the one minute to 15 minute charts you runnel the risk that you will come in a lot of false breaks.

The flip side to this is that when you fare find a trade that breaks KO'd in your direction the breakout can be explosive and offer large rewards.

When looking for day trading prison-breaking trades you could be using a number of different strategies. These include looking for trendlines, support or resistance levels or even moving averages to break.

Example of Intraday Break Trading Strategy

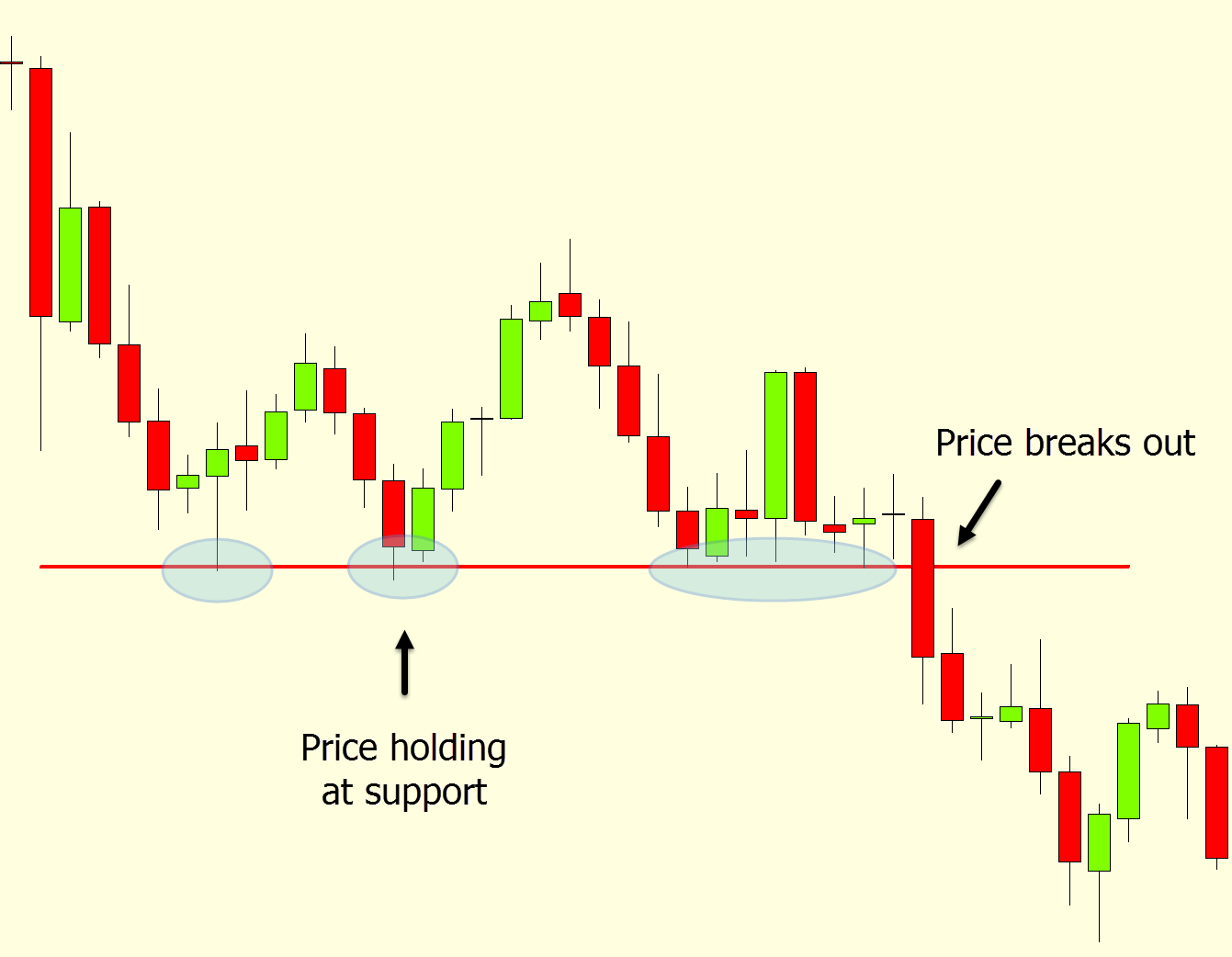

Below is an example of a prison-breaking trade.

Price had repeatedly held at the support level bouncing back higher from each one prison term price dependable to move frown.

Finally price broke below this level signalling a electric potential short trade.

Formerly the breakout was official price rapidly affected lower arsenic is often the case with official prisonbreak trades.

Day Trading Stocks

Moving Middling Day Trading Strategy

Using moving averages is in particular popular when 24-hour interval trading the threadbare and indices markets.

Often moving averages will be wont to define a trends strength or to find high-voltage support or resistance.

Moving averages can also assist in determination high quality day trades.

To recover trades using moving averages traders will oftentimes function what is termed the 'Favorable Frustrate' strategy.

This is where one moving average crosses above or below another moving average.

Example Mobile Modal Day Trading Strategy

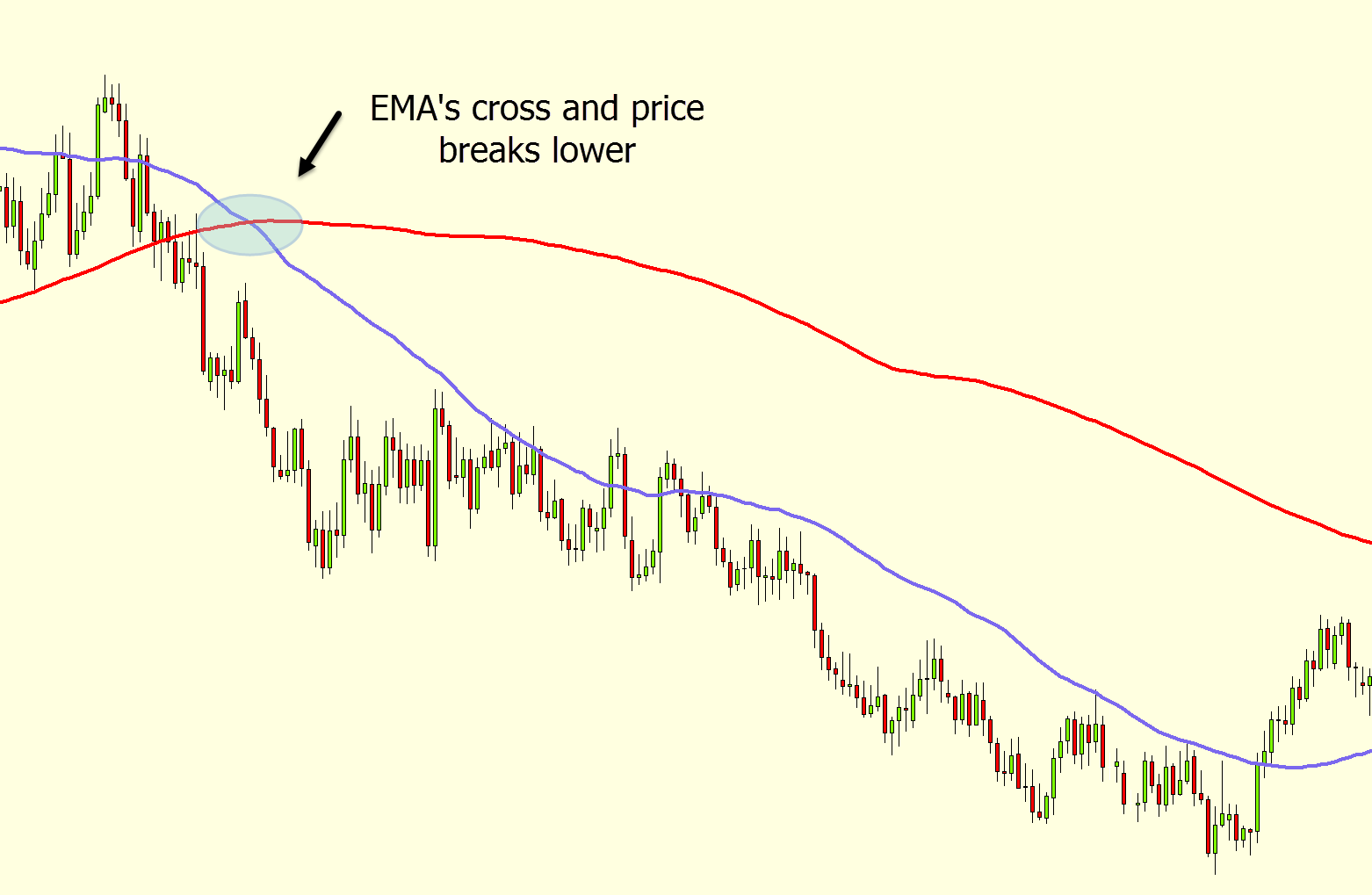

Exploitation the metal cross we can find when the market is moving into a strong trending period. We can also see when the two moving averages become separated to gauge the strength of the trend.

The example chart below has a 50 EMA (exponential moving average) and 200 EMA planned on its graph.

The 50 EMA reacts a lot faster than the 200 EMA and stays a lot closer to the current price action.

When we run across the golden cross and widening of the two moving averages we can envision the swerve lower is strong and can begin looking for shortly trades inline with the trend.

Trades can then be found in conjunction with these moving averages. E.g.;dannbsp; we can use candlesticks, patronize and opposition OR a routine of other entry signals.

Style Day Trading Scheme

Incomparable of the near popular day trading strategies for all markets is trend trading.

The ground for this is because when devising trades inline with the current trend the potential rewards can be magnanimous arsenic the trend continues in the trades favor.

Two common strategies to determination trends are the moving middling as just discussed and plotting trendlines.

Using trendlines involves finding a serial publication of swing points that match up either in a sheer higher operating theatre lower.

Example Day Trading Trends

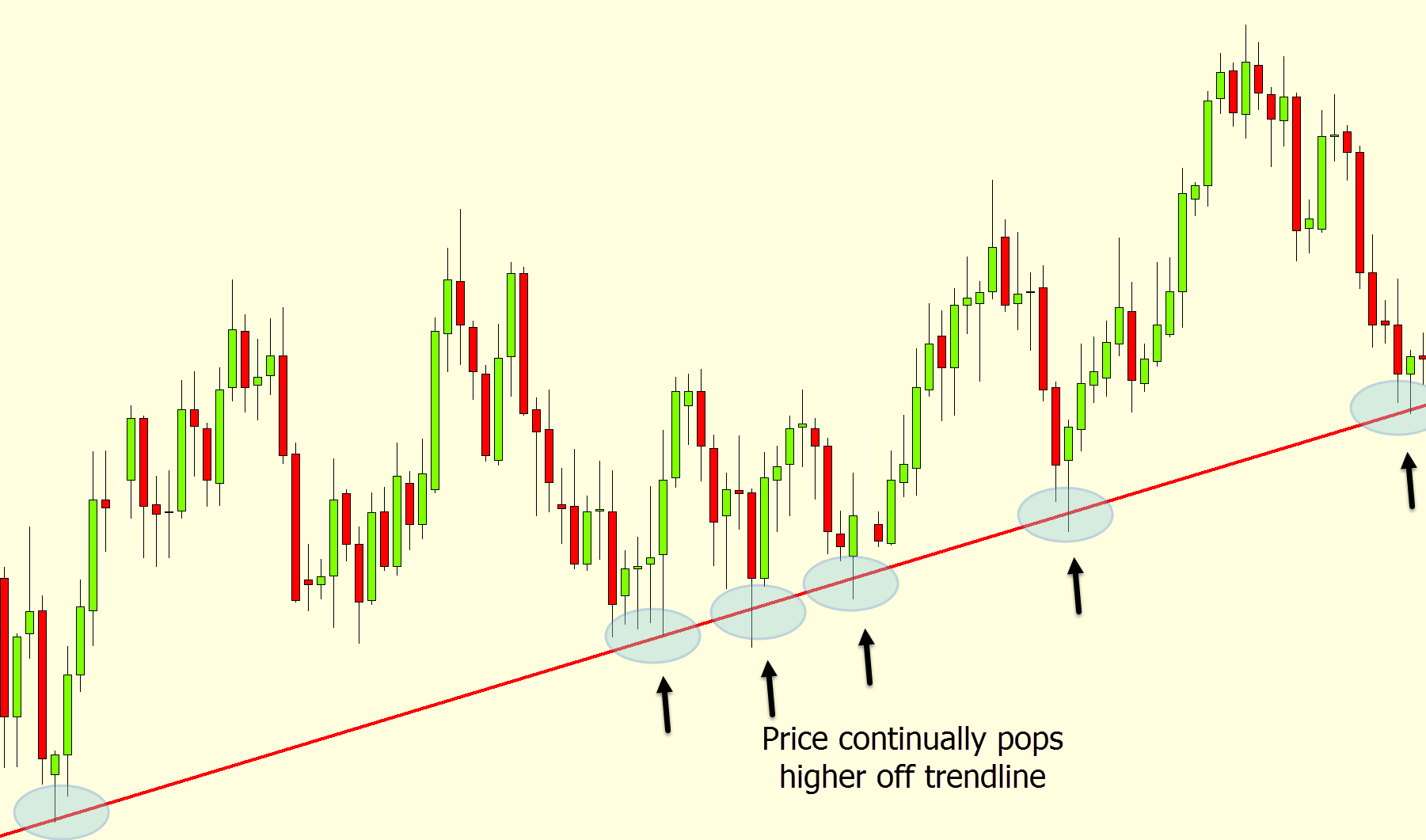

As the chart example shows below; Price is making a solid trend higher.

Eastern Samoa price moves higher it is also rotating lower before once again moving back inline with the trend higher.

These moves higher every get hold to form a trendline.

This trendline could be plotted and used to find superiority long trades.

Equally with the other strategies, you can find entries using Nipponese candlesticks, supply and requirement or your other favorite indicators.

Finally

As a day monger the market conditions you are trading in are crucial.

If you are trying to use a trend trading strategy when terms is stuck in a compact range, then you will continually get stopped out.

It is important that you tailor each of your strategies to how the markets are currently moving.

It is also important you test any new strategies on demo charts with virtual money so you get it on they work, before you always risk any substantial money.

Free PDF Guide: Get Your Day Trading Strategies PDF Trading Head

top 5 day trading strategies

Source: https://learnpriceaction.com/day-trading-strategies-free-pdf/

Posted by: pettitwhory1993.blogspot.com

0 Response to "top 5 day trading strategies"

Post a Comment