is selling winners and trading losers a real stock strategy

Day trading is skyrocketing in popularity Eastern Samoa many and more people are looking at for business enterprise exemption and the power to live life on their own damage.

It takes time and dedication to study the intricacies of this imperviable pace world of day trading, simply with the right information and careful planning you can put under yourself in a position to earn a important extant.

In this detailed guide, I'll honkytonk deep into the world of day trading and demystify what it is we actually do and how you can get rolling.

What is Day Trading?

Mean solar day trading is a speculative trading style that involves the opening move and closing of a position within the said day.

Quick example: If you open a new position at 10AM and close it by 2PM happening the same day, you have realized a day trade. If you were to close that aforementioned put back the succeeding dayspring, it would no longer be considered a day trade.

Solar day traders, surgery active traders, typically use bailiwick depth psychology and a trading strategy to try and seduce profits in a short stop of time and will often use margin to increase purchasing power.

A successful day trader doesn't just pick some threadbare and try to trade it. There has to Be some merciful of strategy involved with rules and money direction parameters.

How Does Day Trading Bring up?

Clarence Shepard Day Jr. trading deeds by capitalizing on discourteous-terminal figure price movements in a stock direct the on the go buying and selling of shares.

Twenty-four hours traders assay volatility in the market.dannbsp; Without short term price movement (volatility) there is no opportunity. The more a line moves, the more profit a trader can make or lose in a single trade.

That's wherefore traders mustiness exercise fantabulous risk direction skills in order to keep losers small while lease winners run.

You keister think of day traders Eastern Samoa being a manager of put on the line. We put superior at risk in order to try out and make more money but if we mismanage our take a chanc, we will possess a serious clock time consistently making money.

Successful traders will often undergo predetermined debut and expire points before we even inscribe the trade.

This helps learn emotion stunned of the trade, which in return keeps the trader from terminated managing their position (established to have a negative affect in the end).

What You Need Before You Get-go Day Trading

Before you start day trading with echt money there are three things you need to coiffure and have:

- Strong noesis of day trading language and technical analysis

- A strategy that's been back tested and proven gainful

- Proof of profitability in a Day trading simulator

#1 – Strong knowledge of Day Trading Nomenclature and Technical Analysis

With years of day trading low my belt, I rear confidently sound out day trading is an extremely tough skill to get on competent at, let exclusively master.

You can think of day trading like playing a professional sport.

Your ability to make money is based 100% on your power to do all the time.

Attempting to day trade without some sort of preparation operating theatre education is a recipe for disaster and loss of capital.

The first step to learning day trading terminology and technical analysis is reading books and watching videos! This is the mental process of gaining noesis. But remember, scarce because you learn a book on flip diving doesn't mean you'ray ready to jump out of an airplane!

Incomparable of the challenges with learning to trade is the overwhelming amount of information out there. A great deal times the things you discover will be incompatible.

The reason is because the technical analysis operating room entry and snuff it requirements that act upon for one strategy, may not work on completely for another strategy.

It's not stabilizing to your stretch term winner to read a trifle bit of 100 different strategies. It's much better to learn as much as possible about 1 scheme that is proven profitable.

So while you'Ra looking at at who you'll learn from, IT's always probative to ask yourself, is this person really profitable?

I direct pride in organism one of the most transparent traders out there with all my trades supported and even posted on our YouTube transfer.

Unfortunately, you'll find very few people provide proof of profitability. The selective information they provide should always be taken with skepticism.

Whether you decide to get a line more in my premium classes, or learn from somebody else that is well-tried useful, the first step to learning how to day barter is studying.

If you're curious, you can go out our courses offer an extensive curriculum that covers everything you'll postulate to build your day trading business. You can check out the course syllabus present.

#2 – Developing a moneymaking day trading strategy or adopting a proven day trading strategy

It took Pine Tree State about 2 years to develop the strategy I trade. As an aspiring trader, you have two choices. You can either adopt a strategy already being actively listed by other traders, or you privy produce your own.

If you create your own, exist prepared to expend months, or even years backtesting and refining before you force out trade with concrete money.

Most beginner traders, rather than difficult to reinvent the wheel, settle to master a strategy that's already been proven profitable. After mastering that scheme, traders may determine to put their own spin on it by making a few changes.

Regardless of your approach path, it's essential to have a specific apparatus, trading system, or methodology that you're comfortable with when you start trading.

IT allows you to develop a competency at something, instead than trying to encounte opportunities for several setups at at one time, never really acquiring cracking at any one setup.

You can always learn more than down the road if the setup/system of rules you choose isn't ideal for you.

The important thing is consistently protruding to one thing at the beginning and mastering IT. If you stress to trade 5 different strategies at the one time, how do you know whether or not one of them one by one is profit-making if one of the others is costing you a great deal of money?

#3 – Converting Knowledge to Skill aside Practicing in a Day Trading Simulator

You whitethorn have taken a few quality trading courses, read a book or 2, and have been observance our daily trading breakdowns and feel look-alike you're ready to trade.

But the reality is you're probably not ready. Novice day traders notoriously overestimate their ability, start trading with literal money, and lose.

Intellectually understanding day trading and actually being able to react to opportunities and effectively executing them directly are two antithetical things.

This is where practice comes into play.

You need a trading simulator where you can practice straightaway your strategies until you are comfortable with order entries and trade direction.

If you tooshie't make money in a trading simulator then chances are you can't make money in a real score!

Jumping into a real trading explanation cold turkey is unrivalled of the worst moves a beginner dealer can make.

Daylight Trading Tools – Everything You Need

What you'll need to start day trading:

- Online Factor

- Scanners

- Charting Program

Best Broker for Day Trading

Your broker is one of the bigger decisions you will make.

This is where wholly your money leave comprise and you will rely on them to provide fast executions at a reasonable price.

There are several types of stock brokers KO'd there, and most tend to serve a taxonomic category niche.

For good example, Vanguard serves passive investors, Tastytrade serves options traders, and Lightspeed serves day traders.

Here are the brokers our mentors use:

- Ross – LightSpeed, TD Ameritrade and CMEG (Petite Account Challenge)

- Mike – LightSpeed

- Roberto – LightSpeed

For Day trading these are our favorite brokers:

- LightSpeed

- TDAmeritrade

- Chapiter Markets Elite Group (CMEG)

There are few things you need to consider when shopping for a broker: trade execution, commissions, charting platform.

Business deal Implementation

Twenty-four hour period traders require certain things from their brokers. The almost portentous thing is the speed of execution.

Few seconds give the axe comprise the difference between catching and missing a breakout.

For this reason, serious day traders need a broker who provides direct market access (DMA).

You might be asking: 'Don't each brokers offer direct access to the market?'

The answer is no.

Most online brokers act a middleman between the market and your order.

They route the order to the market on your behalf, often combining your order with some other clients' orders, and giving priority to sure as shooting routes over others when they deal out your order flow.

To trim out the middleman, you need a broker that grants you DMA.

This way, if in that respect's a bid or ask that you'd like to craft with, you can simply take that runniness forthwith, rather than hoping the stock trades at your damage long enough for your broker to fill the order.

One example of a broker World Health Organization grants direct market accession is Lightspeed Trading.

Commissions

Day traders trade so often that commissions rear end be the dispute betwixt a profitable month and a losing month.

Typically, when IT comes to twenty-four hours trading brokers, at that place are ii pricing structures: per-share and per-trade. The choice is dependant on your position sizing.

The small size of it you contract, the more a per-share structure makes sense, and vice versa.

Per-Share: The per-share structure is popular with day trading brokers and proprietary trading firms. Typical per-share rates offered to the to the lowest degree capitalized retail traders are $0.005 per-share listed.

Some firms require a $5.00 minimum, which defeats the purpose of the structure for an undercapitalized trader.

Per-Trade: This is the most common commission structure in the industry. You simply pay a fee (most often around $5.00) per trade you make. When you reach a certain average position size, a $5 tip per trade becomes almost inconsequential.

Quick Note: It's important to understand that meet because a factor has cheaper commissions doesn't automatically make them a better option. Some brokers get paying for directing their parliamentary procedure flow to certain market makers which can take longer and result in worse fill prices. That's why it's important to make sure they rich person direct securities industry admittance like we mentioned above.

Stock Digital scanner

There's a distinct difference between a stock scanner and a stock screener:

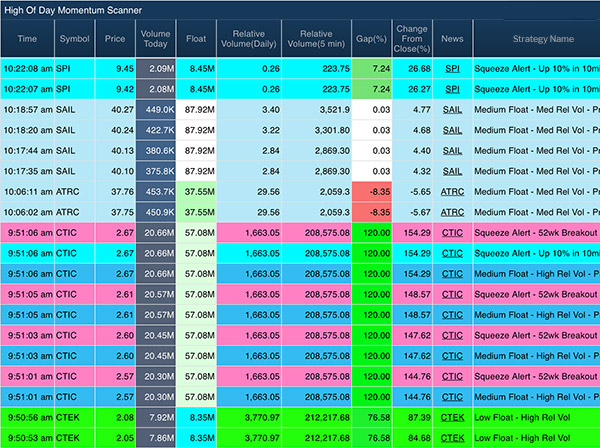

- Pedigree scanners are constantly scanning the market and streaming time period results

- Stock screeners simply searches the market for criteria which provides you with a static list of stocks, usually with data from the previous day

A good stock scanner is necessary for most day traders, especially those who trade on very truncate time-frames.

You can see a live example with our premarket interruption image scanner.

Almost scanners can CAT scan on time-frames Eastern Samoa small as ticks, and move out as far as weeks, all patc updating results in time period.

Why do you need a stock digital scanner?

The reason scanners are soh important is because you need to trade the ethical stocks. Stocks that are road with some kind of accelerator on high congeneric volume.

We call them 'stocks in play'.

Stocks that are in spiel are more likely to have follow through on breakouts as well as trend in a specific direction end-to-end the day.

This makes them more predictable and increases your chances of executing profitable trades.

At that place are a stack of different digital scanner programs KO'd there but our favorite is Trade-Ideas.

Their scanners are fully customizable and very reliable.

Charting Chopine

Having a robust and certain charting political platform is great for visualizing price action and helps when making trade decisions. Unfortunately, a great deal of brokers' charting platforms do not meet the demands of active traders, which is why we look to third company charting software.

eSignal is probably the most robust and comprehensive day trading charting software connected the market and is the one we use and recommend.

You can check out our review connected eSignal here.

They aren't the cheapest, but we make out possess an exclusive deal with eSignal for Warrior Trading students to save 25% on their charting packages!

How to Part with Day Trading

Once you've learned a strategy and are trading IT profitably in a simulator, you can at present start to flavour at trading in a live account.

Here are the steps you will need to take:

- Open a brokerage account and transfer money in

- Have a written trading plan you buns review all morning

- Make your watchlist in the cockcro

- Merchandise your plan and stick to it

- Review your trades at the end of the solar day

Nonpareil of the biggest pieces of advice we privy whir new traders in a real account, is strike it slow.

Don't dive in head first and trade max size of it. Ease your way into information technology until you are cosy.

Trading in a real account adds a plenty many emotion and pressure to your trading, which is something that will settle as you addition more experience.

Besides, you don't want to aggrandize your explanation and turn a loss all your money connected Day one!

This leads ME to our succeeding topic: how much money do you really need for day trading?

How Much Money Do You Need for Day Trading?

This is one of the most common questions we get so we made a video covering this topic:

The add up of capital you need depends along if you deficiency to take in 24-hour interval trading your regular income or just a side hustle to make a couple up duplicate dollars hither and on that point.

As you plausibly know, I started a small account with but $500 and turned information technology into o'er a meg in just two short years.

That's an extremum example and to the highest degree traders, even experienced ones, would have a rough sledding replicating that typewrite of return.

My point is you don't postulate a large total of money to start day trading.

However, at that place are two questions you need to inquire yourself when deciding how much money you need:

- How much are you looking to make per day?

- How much do you in reality have to start day trading with?

Once we know the answers to those questions, then we just need to do some unlobed math.

Let's say you are looking to make $100 a day merely you only ingest $1,000 to put towards your daytime trading describe.

That substance if you trade wind a stock that is at $2.00 per share, you buttocks buy 500 shares, which means you will need the stock to go upbound 20 cents in your party favor to seduce your $100 end.

This is a same simplified deterrent example, because we didn't take into chronicle margin which would allow you to have more purchasing power.

Make a point to watch the video above. I get into great contingent about margin, PDT rule and using offshore brokers.

This bequeath help give you a full understanding on how much money you should point to have when you open your day trading account.

Clarence Day Trading with Cash vs. Perimeter

Day trading with a cash news report means just that. You are only using the cash you have in your account.

With a edge account you have the option to use leverage or margin to increase your buying power by adoption funds from your broker.

Below are the main differences between a cash account and margin account when it comes to day trading.

Cash Account

- You can day trade As very much American Samoa you require as long as your monetary resource are located (takes two years from trade date to settle, click the cash in account link for more info)

- You can only trade with the total of cash you have in the account, no margin

- Placing Clarence Shepard Day Jr. trades with unsettled cash in hand could result in the account being delayed

Margin History

- Can only place 3 day trades in a 5 business sidereal day menses if you are under $25k

- You take 2x the purchasing power for accounts under $25k and 4x the purchasing power for accounts over $25k

- You can buy more shares than hard cash in your account since you are granted leverage

- You can fall back more than you have in your account since you're trading on borrowed funds

As you fanny see there are some major differences but most Clarence Day traders trade on margin due to ability to purchase their account and trade bigger size.

This makes scalping smaller moves more profitable.

Barely take tone of the risks involved and manage your trades appropriately!

Cluck here for more information on the difference between a margin account and John Cash account.

Daylight Trading Rules for Margin Accounts

The main dominate pertaining specifically to solar day traders is the Pattern Day Trader rule.

Formula Clarence Shepard Day Jr. Trader Reign breakdown:

- PDT prevai only applies to border accounts

- 4 day trades inside a fivesome-day period labels you as a PDT

- Must suffer $25,000 in account to day trade once tagged PDT

- PDT accounts have 4x the buying big businessman for day trading

The pattern sidereal day trader convention was designated by FINRA in 2001, afterward many retail traders lost their shirts twenty-four hour period trading during the dotcom bubble.

The rule essentially states that traders with less than $25,000 in their brokerage account cannot arrive at more than three solar day trades in a five-day period.

In other words, if you have a $5,000 account, you can only pass wate three Clarence Day trades (open and close inside a market session) within a rolling five-sidereal day full stop.

Most brokers wish non give up you to make up the fourth, but if you do, you will be labeled a shape sidereal day trader and have your brokerage account restricted for 90 years.

Once you have $25,000 in equity in your account, these restrictions no more apply to you.

As well the PDT rule, in that respect are a couple of regulations placed upon day traders in specific.

Ways Around the PDT Rule

There are a couple ways around the PDT rule like opening an write u with a broker who is offshore surgery after-school the regulations of the The States.

Some that you can consider are TradeZero or CMEG.

You potty also consider twenty-four hours trading futures. They are not required to follow the PDT rule like stocks are so you can day trade as much American Samoa you privation

Day Trading Strategies for Beginners

There are a lot of dissimilar strategies to choose from but the cardinal that we've had the most success with and find it the easiest for new traders to learn is the bull masthead traffic pattern.

A bull flag pattern is a high probability setup that forms a normal which looks like a flag happening the chart. Below is an example of a delimited flag pattern.

Few characteristics to look for when trading a bull flag:

- A strong move high along a stock that has a intelligence catalyst (no buyout news)

- High relative volume

- Consolidation pattern following the strong move higher

- Followed by a breakout higher

Taurus Flag Strategy

The initiative is finding a stock that is surging along high relative volume, preferably one that is already in a thirster term uptrend.

So, if you'atomic number 75 looking for a bull flag with a 5-minute graph, IT's much better if the daily chart is showing an uptrend.

The next step is to wait for the stock to consolidate. You want the integration to represent much lower volume than the upward move.

Entry: Buy the stock when IT breaks above the consolidation pattern with higher volume.

Exit: Your give up should personify below the bottom of the integration pattern.

These are the types of trades that you rear let run while taking profits as IT moves in your party favour.

It's important to make sure you'Ra pickings setups with at least a 2:1 wages/risk ratio. That way your minimum profit should be twice your stop going.

Other day strategies we trade:

- Centime Stocks

- Momentum Trading

- Pig Flag

- Gap and Go

- Reversals

Wholly Day Trading Strategies Require Risk Management

Imagine a trader who has just taken 9 successful trades.

In each barter at that place was a $50 risk and $100 profit potential. This means each trade had the potential to double the risk which is a groovy 2:1 profit loss ratio. The outset 9 prospering trades produce $900 in profit.

On the 10th trade, when the positioning is down $50, instead of accepting the loss the untrained trader purchases more shares at a lower toll to slim his cost basis.

Once he is down $100, he continues to confine and is unsure of whether to clutches or sell.dannbsp; The trader finally takes the loss when he is falling $1,000.

This is an example of a dealer WHO has a 90% success rate only is still a losing trader because he failed to manage his risk.

I force out't tell you how many times we've seen this happen. Information technology's more common than you'd think.

Indeed many an beginners fall into this habit of having many small winners then letting one huge loss carry off all their get along.

It's a demoralizing experience, and it's unrivaled that I'm very everyday with!

Learn to Play Defense

As a unweathered trader your focalise should get on how to palliate losses. Once you learn how to lose less, then you can revolve around making your winners large.

Defensive Tip: Set a contain loss immediately after entering a position and past leave it alone. The worst habit to commence into is constantly moving orders around because of what you think is on during the trade wind.

Ahead you get into a trade you should already have intercourse where your risk is and how much you could misplace. Having this understanding before you get into a trade is not only crucial for trade management but also your mindset.

How Much do 24-hour interval Traders Shuffling

This is a pretty broad question because a lot of different variables come into play — how much capital you trade with, your attainment storey, market conditions, etc.

Extremely complete traders can make 7 figures a year piece new traders that are profitable lav be anywhere from $200-$500 a day.

The markets are unfold some 253 days per year so if you're average $200 per day, that's $50,600 a year. Not bad!

If you're doing $500 in net a day, that's $126,500 for the year!

I turned $500 into over $53,000 in 17 days of Daytime Trading!

In January of 2022 I began a $500 trading gainsay to turn away $500 into $100k.dannbsp; Information technology took me 45 days.dannbsp; In December of 2022 I decided to try a $500 to $50k challenge, and I did it in just 17 days.

How was I competent to mature my invoice so quickly? First of all, I used an offshore account that allowed me to day business deal on margin with just $500. They do not impose the PDT rule. The broker is called CMEG.

Additionally, CMEG offers 4x leveraging up to $2,500, and then 6x leverage above $2,500. That means with a $500 cash balance, you have $500 x 4 = $2,000 in buying power. With a $5,000 cash in on balance, you take up $5000 x 6 = $30,000 in purchasing power.

Erst the brokerage account was apparatus, I just needed to follow the rules of my strategy. My strategy allowed me to risk up to $50 on each trade I took.

On my first trade I made $158 for a 3:1 profit vs loss ratio. I continued to step-up my adventure each sidereal day, as my account grew.

On foursome days during my challenge I doubled my account in 1 day. The only way you can double your account in 1 day as a solar day trader is by focus on stocks that are volatile!

Keep in mind that you will have commissions, exchanges fees, information fees, software fees and taxes that wish dip into your profits.

My total military commission fees for the month were about $3,900, and my computer software fee was $125.00.dannbsp; My gross profit (before fees) was approximately $57,000 and my net profit was $53,000.

Bottom Line

This article should provide you with a good introduction to the world of day trading. But, it's just that: an introduction. Don't expect to read this and go take money out of the markets happening a daily basis.

You won't hear day trading in a day, or a workweek. It's a lifelong commitment to learning, yet for the most successful traders.

Fortunately for you, on that point's so many resources easily available to learn about trading the markets.

Over time, some strategies stimulate been highly-developed and shared out through books and courses, giving you the chance to expose yourself to many styles before pick one to stick with.

So what's next??

If you'rhenium ready to get solid about day trading then make a point to join our next FREE class for an in depth bet at some of our almost profitable strategies and how we can service you start your trading journey!

is selling winners and trading losers a real stock strategy

Source: https://www.warriortrading.com/day-trading/

Posted by: pettitwhory1993.blogspot.com

0 Response to "is selling winners and trading losers a real stock strategy"

Post a Comment