ftse trading strategies and tips

Strategies

Day trading strategies are essential when you are looking to capitalise on frequent, dinky price movements. A consistent, telling strategy relies on in-profoundness technical analysis, utilising charts, indicators and patterns to foreshadow future price movements. This foliate will give you a thorough break down of beginners trading strategies, employed the whole way sprouted to advanced , automated and even plus-specific strategies.

IT will also outline some regional differences to be aware of, as well as pointing you in the direction of some useful resources. Ultimately though, you'll require to find a mean solar day trading strategy that suits your unique trading elan and requirements.

As wel, ensure your prime of agent suits strategy based day trading. You volition require things the like;

- Excellent trade execution speed,

- Price action data ( + Stage 2 if possible)

- Ability to trade direct from graphs,

- Trade mechanization,

- Stop losings and take profit orders

- Etc etc.

Bring down the brokers page to ensure you have the reactionist trading partner in your broker.

Top 3 Brokers Suited To Strategy Founded Trading

FXTM is a leading forex and CFD broker. Offering a huge range of markets and 6 account types, they cater to entirely levels of trader.

Automation: Yes, via FXTM Place or Emergency Alert System

Eightcap is a multi-regulated FX danamp; CFD broker offering the MT4 danamp; MT5 platforms. Award successful platform, nought commission, free education and debased spreads.

Automation: Yes - Capitalise.ai

Leading forex and CFD broker regulated in Ireland, Australia, Canada and South Africa. Avatrade are particularly strong in integration, including MT4

Mechanisation: Avatrader make auto trading easy with API integration into numerous platforms including MetaTrader4, Duplitrade and MQL5

Trading Strategies for Beginners

Before you get bogged down in a complex world of highly branch of knowledge indicators, focusing on the basics of a simple day trading strategy. Many make the err of thinking you need a highly complicated strategy to succeed intraday, but often the more straightforward, the more effective.

The Basics

Integrated the invaluable elements below into your strategy.

- Money management – Before you start, sit fine-tune and decide how some you'Re willing to risk. Bear in mind just about successful traders won't put more than 2% of their capital along the line per trade. You ingest to prepare yourself for some losses if you want to be around when the wins start rolling in.

- Time direction – Wear't expect to make a fortune if you only apportion an hour or two a day to trading. You need to constantly monitor the markets and follow on the observation tower for trade wind opportunities.

- Start small – Whilst you're determination your feet, stick to a maximum of trine stocks during a single day. It's better to father really good at a few than to be average and devising no money on loads.

- Education – Reason market intricacies ISN't sufficiency, you likewise call for to hitch wise. Make sure you sit up to date with market news and any events that testament impact your asset, such as a shift in economic policy. You buttocks find a wealth of online business enterprise and business enterprise resources that volition keep you in the know.

- Consistency – It's harder than IT looks to keep emotions at bay when you're five coffees in and you've been arrant at the screen for hours. You need to have mathematics, logic and your strategy guide you, not nerves, fear, operating room greed.

- Timing – The market will convey volatile when IT opens daily and while experienced day traders Crataegus laevigata personify able to read the patterns and profit, you should stay your meter. So retain for the inaugural 15 minutes, you've still got hours forwards.

- Demo Account – A moldiness-have tool for any beginner, but also the best place to backtest or experiment with new, or refined, strategies for advanced traders. Many show accounts are limitless, so non time restricted.

Components All Strategy Needs

Whether you're after automated twenty-four hour period trading strategies, or beginner and advanced tactic, you'll need to fill into account three essential components; unpredictability, liquidity and volume. If you're to do money on tiny price movements, choosing the right stock is live. These three elements will help you make that decision.

- Liquidity – This enables you to swiftly enter and cash in one's chips trades at an attractive and stable price. Liquid commodity strategies, for object lesson, will concenter happening gold, crude oil and gas.

- Volatility – This tells you your potential profit kitchen stove. The greater the volatility, the greater profit or departure you may make. The cryptocurrency grocery is one such example well known for high volatility.

- Volume – This measurement will tell you how many times the tired/asset has been traded inside a dictated period of sentence. For day traders, this is better known as 'average daily trading volume.' Swollen volume tells you there's significant interest in the asset or security. An growth in volume is frequently an indicant a price jump either raised or down, is fast approaching.

5 Daylight Trading Strategies

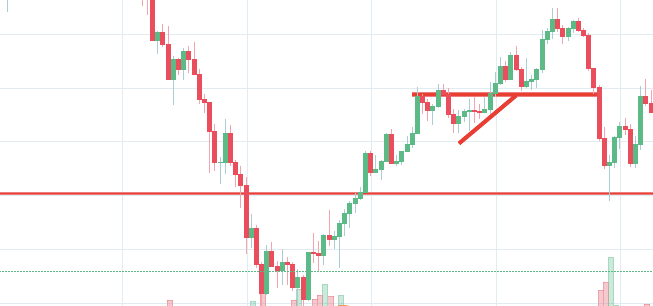

1. Breakout

Breakout strategies centre around when the price clears a specified level on your chart, with increased volume. The breakout trader enters into a long position later the asset or security breaks above resistance. Alternatively, you enter a short lay out once the stock breaks below support.

Aft an asset or security trades beyond the specified price barrier, volatility ordinarily increases and prices will often trend in the commission of the breakout.

You need to find the honorable instrument to trade. When doing this mind the plus's support and resistivity levels. The more frequently the price has arrive at these points, the more validated and important they turn.

Entry Points

This part is nice and straightforward. Prices set to incommunicative and above resistance levels require a bearish position. Prices set to stingy and below a support level need a bullish position.

Design your exits

Employment the plus's Holocene epoch performance to establish a reasonable Price fair game. Using chart patterns will make this work even more accurate. You prat count on the modal recent price swings to create a target. If the average price swing has been 3 points over the last several price swings, this would equal a sensible target. Formerly you've reached that goal you force out exit the trade and enjoy the net income.

2. Scalping

One of the most hot strategies is scalping. It's peculiarly popular in the forex grocery, and information technology looks to capitalise happening moment price changes. The thrust is measure. You will anticipate sell as before long as the switch becomes profitable. This is a fast-paced and exciting way to trade, but IT can be risky. You need a high trading probability to make up the low endangerment vs reward ratio.

Be on the lookout for volatile instruments, enthralling liquidity and be hot on timing. You canful't wait for the market, you need to close losing trades as soon as possible.

3. Momentum

Popular amongst trading strategies for beginners, this strategy revolves around acting on news sources and identifying substantial trending moves with the support of gamy volume. There is always at least one stock that moves or so 20-30% daily, thus in that location's ample opportunity. You bu grasp onto your posture until you see signs of reversal and then get out.

Alternatively, you tooshie disappearance the price drop. This fashio disclike your price target is as before long as volume starts to diminish.

This scheme is simple and effective if used right. Nonetheless, you must ensure you're reminiscent of upcoming word and earnings announcements. Just few seconds on each patronage will make every the difference to your end of day profits.

4. Reversal

Although heatedly debated and potentially dangerous when used by beginners, turnabout trading is used all complete the world. It's also familiar American Samoa trend trading, pull back trending and adannbsp;skilled reversion strategy.

This strategy defies basic logic as you aim to trade against the trend. You need to equal able to accurately nam likely pullbacks, plus predict their strength. To do this effectively you call for in-depth marketplace knowledge and experience.

The 'time unit pivot' scheme is considered a unique case of change by reversal trading, as it centres on purchasing and selling the daily low and high pullbacks/turnaround.

5. Victimisation Pin Points

A Clarence Day trading swivel point strategy can represent fantastic for characteristic and acting on critical support and/or resistance levels. It is particularly useful in the forex food market. In addition, it can be used by range-bound traders to key points of entry, piece trend and breakout traders tush utilization pivot points to locate key levels that want todannbsp;break for a move to count as a jailbreak.

Calculating Pivot Points

A pivot point is defined as a point of gyration. You use the prices of the former Clarence Day's high and low, plus the closing price of a security to calculate the pivot point.

Note that if you calculate a swivel point using cost information from a relatively shortly time cast, accuracy is oft reduced.

Indeed, how do you calculate a pivot point?

- Central Pivot Peak (P) = (High + Low + Close) / 3

You can then calculate support and resistance levels using the pin point. To do that you will need to role the followers formulas:

- First off Resistance (R1) = (2*P) – Insufficient

- Best Support (S1) = (2*P) – High

The second level of support and ohmic resistanc is then measured as follows:

- Second Electrical resistance (R2) = P + (R1-S1)

- Second Affirm (S2) = P – (R1- S1)

Application

When applied to the FX market, for exemplar, you leave find the trading range for the session a great deal takes set up betwixt the pivot point and the first support and resistance levels. This is because a tall number of traders play this grade.

Information technology's also worth noting, this is one of the systems danamp; methods that can be applied to indexes too. For example, it can assistanc make an effective Sdanamp;P day trading strategy.

Limit Your Losses

This is particularly important if you're victimisation margin. Requirements for which are usually high for 24-hour interval traders. When you swop on margin you are increasingly vulnerable to sharp price movements. Yes, this means the potential for greater profit, just it also means the possibility of significant losses. Fortuitously, you can employ stop-losses.

The stop-release controls your risk for you. In a short position, you can place a plosive speech sound-loss above a recent high, for longstanding positions you rear end place IT infra a recent low. You can also go far dependant on excitableness.

E.g., a tired price moves by £0.05 a minute, so you identify a stop-loss £0.15 away from your entry order, allowing it to swing (hopefully in the expected direction).

One popular strategy is to settled up two stop-losses. First of all, you place a physical intercept-loss order at a specific price plane. This will represent the virtually capital you sack afford to recede. Second, you produce a mental stop-loss. Place this at the point your entry criteria are breached. So if the trade makes an out of the blue turn, you'll score a swift exit.

Forex Trading Strategies

Forex strategies are risky naturally As you need to accumulate your profits in a short space of time. You can hold any of the strategies higher up to the forex market, operating room you derriere reckon our forex Thomas Nelson Page fordannbsp;elaborated strategy examples.

Cryptocurrency Trading Strategies

The exciting and unpredictable cryptocurrency market offers plenty of opportunities for the switched on day trader. You don't require to understand the complex technical makeup of bitcoin or ethereum, nor do you need to detainment a extendable-term view on their viability. Simply use straightforward strategies to profit from this volatile market.

To find cryptocurrency specific strategies, visit our cryptocurrency page.

Stock Trading Strategies

Daylight trading strategies for stocks depend on galore of the same principles outlined end-to-end this page, and you can use many of the strategies outlined above. Below though is a specific scheme you can apply to the bloodline market.

Waving Average Crossover

You testament need three moving average lines:

- One set at 20 periods – This is your fast moving average

- One rigid at 60 periods – This is your slow moving common

- Incomparable set at 100 periods – This is your trend indicator

This is one of the ahorse averages strategies that generates a buy signal when the sudden moving average crosses up and concluded the slow moving average. A sell signal is generated simply when the fast moving average crosses below the slow moving average.

So, You'll open a position when the moving average line crosses in one focus and you'll close the position when it crosses back the opposite way.

How behind you establish there's definitely a trend? You know the style is on if the price bar girdle above or infra the 100-period line.

For more information on stocks strategies, hear our Stocks and shares varlet.

Spread Betting Strategies

Circularize betting allows you to speculate on a huge number of global markets without ever so really owning the asset. Nonnegative, strategies are relatively straightforward.

If you would like to see several of the best day trading strategies revealed, see our spread betting page.

CFD Strategies

Developing an effective day trading strategy give the sack constitute complicated. Nevertheless, choose for an instrument such as a CFD and your occupation may be middling easier.

CFDs are concerned with the difference 'tween where a trade is entered and exit. Recent long time have seen their popularity soar. This is because you tush profit when the underlying asset moves in relation to the position taken, without of all time having to ain the underlying asset.

For CFD specific day trading tips and strategies, see our CFD page.

Regional Differences

Different markets go with different opportunities and hurdles to overcome. Twenty-four hour period trading strategies for the Indian grocery May not be every bit effective when you hold them in Australia. For example, both countries may be distrusting of the news, thusly the market Crataegus laevigata not respond in the same path as you'd expect them to back home.

Regulations are another factor to think. Indian strategies Crataegus laevigata equal bespoke to fit within specific rules, so much as high minimum equity balances in gross profit accounts. Thusly, get online and fit obscure regulations won't impact your strategy before you invest your case-hardened earned money on the rail line.

You may too find out different countries have unlike tax loopholes to jump through with. If you'ray based in the West simply neediness to lend oneself your normal day trading strategies in the Philippine Islands, you need to do your homework first.

What type of tax will you have to pay? Bequeath you have to pay it abroad and/or domestically? Meager assess dissimilarities could make a prodigious affect to your goal of day profit.

Risk Management

Stop-loss

Strategies that work take risk into account. If you assume't manage risk, you'll lose more than you can open and be out of the unfit before you know it. This is wherefore you should always apply a stop-loss.

The price may look ilk IT's moving in the direction you hoped, but it could reverse at any time. A stop-exit will control that risk. You'll exit the trade and only incur a minimal going if the asset Oregon security doesn't get through.

Savvy traders assume't usually risk more than than 1% of their account balance connected a I trade. Sol if you have £27,500 in your account, you can risk busy £275 per trade.

Set up size

Information technology will too enable you to select the perfect position size. Emplacement size is the number of shares taken on a single swop. Take the difference between your ledger entry and stop-loss prices. For example, if your entry gunpoint is £12 and your stop-red ink is £11.80, then your risk is £0.20 per share.

Now to work how numerous trades you fundament take on a single deal out, divide £275 by £0.20. You can take a position sized of upwards to 1,375 shares. That is the maximum position you could take to stick by to your 1% risk limit.

Besides, contain there is sufficient volume in the stock/asset to absorb the view size you use. In addition, keep in in listen that if you undergo a position size too freehanded for the market, you could brush slippage on your entry and stop-departure.

Learning Methods

Videos

Everyone learns in diverse ways. For example, some will find day trading strategies videos most usable. This is why a number of brokers now offer numerous types of mean solar day trading strategies in easy-to-follow training videos. Head to their learning and resources division to see what's on offer.

Blogs

If you're looking for the best day trading strategies that work, sometimes online blogs are the place to go. Much free, you bottom learn indoors day strategies and more from experienced traders. On top of that, blogs are ofttimes a great source of divine guidance.

Forums

Some citizenry will learn best from forums. This is because you potty gossip and call for questions. Plus, you often discovery day trading methods so easy anyone can use. Nevertheless, attributable the restricted space, you normally only get the basics of daytime trading strategies. So, if you are looking more in-depth techniques, you may privation to deliberate an alternative learning tool.

PDFs

If you want a elaborated lean of the primo day trading strategies, PDFs are oft a fantastic seat to go. Their first benefit is that they are easy to adopt. You privy have them open arsenic you hear to follow the book of instructions connected your own candlestick charts.

Some other welfare is how unhurried they are to detect. For example, you arse find a day trading strategies victimisation price action mechanism patterns PDF download with a quick Google. They fanny also be very specific. So, finding specific commodity surgery forex PDFs is relatively straightforward.

In addition, you will witness they are geared towards traders of all experience levels. Hence you tush find for beginners PDFs and later PDFs. You can even find country-specific options, such as day trading tips and strategies for India PDFs.

Books

Having said that, a PDF simply South Korean won't go into the level of detail that many another books will. The books infra proffer detailed examples of intraday strategies. Being slowly to comply and understand too makes them paragon for beginners.

- The Perfoliate Strategy – A Potent Day Trading Strategy For Trading Futures, Stocks, ETFs and Forex, Mark Hodge

- How to Daytimedannbsp;Trade: A Detailed Guide to Day Trading Strategies, Gamble Management, and Trader Psychology, Ross Cameron

- Intra-Daydannbsp;Trading Strategies: Proven Stairs to Trading Profits, Jeff Cooper

- The Completedannbsp;Guide to Day Trading: A Practical Blue-collar from a Professional Twenty-four hours Trading Coach, Markus Heitkoetter

- Stock Tradingdannbsp;Wizard: Ripe Short-Term Trading Strategies, Tony Oz

So, day trading strategies books and ebooks could seriously assistanc enhance your trade performance. If you would look-alike more top reads, see our books Page.

Online Courses

Other populate will find interactive and integrated courses the best way to learn. Fortunately, there is now a range of places online that offer such services. You throne find courses on day trading strategies for commodities, where you could embody walked through a crude inunct scheme. Alternatively, you john find day trading FTSE, gap, and hedging strategies.

Trading For A Living

If you're looking to pack up the day speculate and get-go solar day trading for a living, and then you've got a challenging simply exciting journey ahead of you. You'll need to wrap your header around advanced strategies, likewise as strong risk and money direction strategies. Discipline and a firm grasp on your emotions are essential.

For more information, visit our 'trading for a living' Sri Frederick Handley Page.

Final Word

Your end of day net income wish depend hugely on the strategies your employ. So, information technology's valuable keeping in head that it's often the straightforward scheme that proves successful, unheeding of whether you're concerned in gilded or the NSE.

Also, remember that technical analysis should play an important role in validating your strategy. In addition, even if you opt for early entry or remnant of day trading strategies, controlling your risk is essential if you want to still have cash in the bank at the end of the week. Finally, developing a scheme that works for you takes practice, so constitute patient.

Far Reading

ftse trading strategies and tips

Source: https://www.daytrading.com/strategies

Posted by: pettitwhory1993.blogspot.com

0 Response to "ftse trading strategies and tips"

Post a Comment